Have you seen this man?

Eric Gay/AP

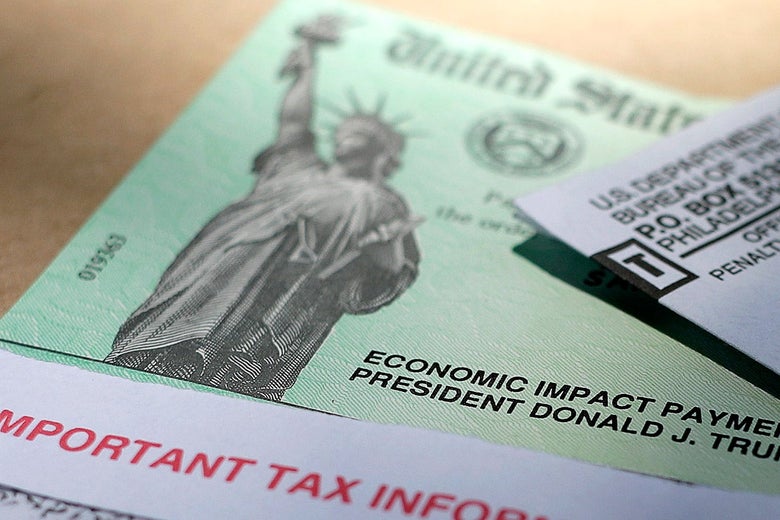

There’s a viral pandemic going on, which has caused the economy to crash. Many U.S. residents who previously lived comfortably on a day-to-day basis are losing some or all of their income and having trouble paying bills. In response, government leaders from both parties have proudly announced generous new unemployment benefits, a massive “stimulus” which will deliver cash to individual Americans, a program of no-interest loans that will allow small businesses to retain workers, and arrangements with landlords and lenders to allow the deferment of rent and mortgage payments.

Sounds great! There’s a catch, though: None of those things work.

At least, they don’t work in the sense of reliably delivering relief to everyone who is eligible for the programs and needs them. You can’t get unemployment benefits until you register for unemployment, and many people can’t register for unemployment, even if they’re calling the office hundreds of times a day, because state systems are overloaded. You can get your stimulus if the IRS already has a direct deposit account number for you—but if you didn’t get a refund this year or last year, it doesn’t have that number, and the website where you’re supposed to be able to enter it often just returns a message that says “payment status not available.” The same applies for small business loans: Those who are eligible are supposed to apply through their existing banks, but your bank (or your boss’s bank) may not have even posted information on its website about how to apply before announcing that the window for applications had closed. And as far as monthly housing payments go, it turns out that for many customers of major banks what’s being offered isn’t deferment, wherein you skip payments now and add them on to the end of your agreement, but rather forbearance, wherein the money from any skipped payments is simply all due in a lump sum a few months from now, i.e. when you will almost certainly not have yet found a job that pays enough to have made up the income you just lost. If you’d like to speak to a representative of your bank about that, there might be one available if you’re willing to wait on hold for sixteen or seventeen years.

If you are fortunate enough to have not required the services of America’s social safety net recently, this may be surprising to you. If you have—perhaps by being offered an unaffordable health insurance plan via the federal COBRA program or the Obamacare exchanges after losing your private coverage—you will be less surprised. If you years ago made the dubious personal decision to be born into one of the bottom wealth quintiles in this country, where levels of socioeconomic mobility are lower than those in Portugal and Estonia, it was presumably not surprising at all.

That’s because government programs in the United States—even those supported by the purportedly pro-government party—are not designed to solve problems. Rather, they are designed to solve a given problem only to a degree—and that degree can’t require an amount of spending that would necessitate financial sacrifice on the part of high-income taxpayers. This is not a leftist conspiracy theory, but the overt position of the party’s leaders, who believe they will not be able to achieve crucial voting margins in upscale suburbs if they authorize too much taxation and spending.

Some voters accept this status quo because they believe the government can’t ever work. But the government works smoothly, responsively, and generously—and is continuing to do so, in crisis—for people and entities who are wealthy enough to hire lobbyists or have personal relationships with politicians. Large banks can borrow directly from the Federal Reserve at zero-percent interest, and they are receiving middleman fees for prioritizing their biggest clients in the “small” business lending program, which is how 71 companies large enough to have publicly traded stock received money through it. (The oil industry in particular did well.) For-profit chains of nursing homes have managed to already get laws passed that exempt them from being sued over the deaths of patients and staff members who received inadequate care and protective equipment. A provision in one of the stimulus bills lifted the cap on how much depreciation real estate investors can deduct, a benefit that only applies to individuals with more than $500,000 worth of non-real estate annual income—and which was made retroactive in a way that will allow them to claim benefits that apply to income earned two years before the coronavirus ever arrived. .

To put it cynically, the job of much Democratic legislation is to make liberal voters of means feel good that something is being done for the less fortunate, not necessarily to actually do that thing. Some people might really benefit, but the process of doing so will be time-consuming and byzantine, and will only affect their overall life situation at the margins. (Consider the “free college in New York state” program which New York Gov. Andrew Cuomo often takes credit for starting. Seventy percent of those who apply to the program are rejected—it doesn’t cover the costs of housing or class materials, but you also can’t participate in it if you’re a part-time student, i.e. someone who needs to work on the side to cover the costs of housing and class materials. During his 2018 reelection campaign Cuomo belittled his opponent’s proposal to raise taxes on incomes over a million dollars a year and called it a political “non-starter.”) Voters who might need better benefits have the choice of either accepting these as the best they can get or not voting at all, because the other party wants new programs to be inadequate on purpose—and wants to cut back the ones that do work, like Social Security and Medicare—so as to “incentivize” individuals to work harder to get a job or to get a better job or to save more. The choice is between drowning gradually or all at once.

The corona crisis is exposing a new class of voters to the drawbacks of this half-a-loaf style, and some elected, non-leftist Democrats have noticed, or are at least signaling that they might be interested in noticing if the wind continues to blow a certain way. “Our constituents have a lot of questions about where the hell this $3 trillion is going and why it isn’t coming into their pockets,” Pennsylvania Rep. Mary Gay Scanlon told Politico in an article about rank-and-file Democratic backlash against the party’s limited stimulus efforts. Washington Rep. Denny Heck, grappling with the effects of the recess and the limits on the ability of the House to operate remotely, told the Washington Post that the majority was “ill-prepared” for the crisis and that “there are a lot of things going on with how this money is being spent that are clearly not in keeping with the spirit of what we intended.” Joe Biden, who ran a primary campaign that was about not trying to do too much, is giving interviews in which he curses out big banks and says the next stimulus bill should be “a hell of a lot bigger” than $2 trillion.

On Monday, Nancy Pelosi, feeling some heat, said she’d “consider” proposing a plan that would issue universal “guaranteed income” payments for the duration of the economic crisis. There are no fiscal moderates in a foxhole.

Readers like you make our work possible. Help us continue to provide the reporting, commentary and criticism you won’t find anywhere else.

Join Slate Plusfrom Slate Magazine https://ift.tt/2VKeuZ3

via IFTTT

沒有留言:

張貼留言