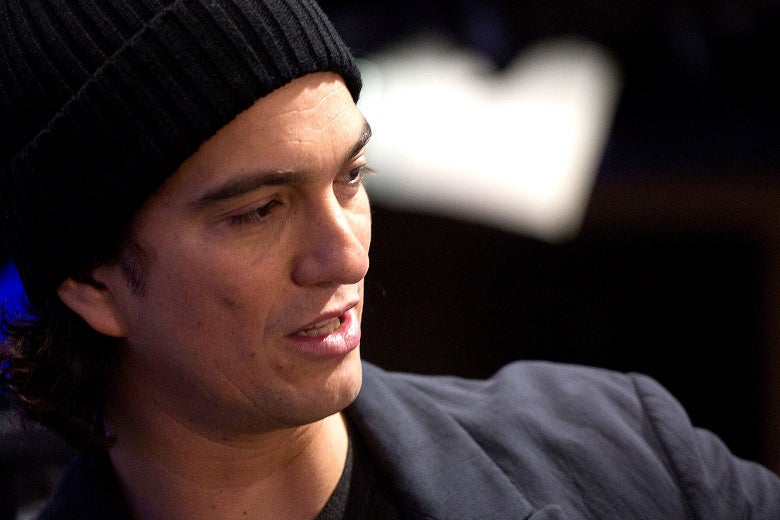

Adam Neumann in New York in January 2018.

Mark Lennihan/AP

We fundraised. We incorporated. We fundraised. We leased. We sublet. We fundraised. We made some weird decisions. We scheduled an IPO—and then We collapsed.

That, in short, is the story of the spectacular rise and fall of the We Company, née WeWork, whose founder and CEO Adam Neumann chose to “step back” on Tuesday. He will continue to serve as nonexecutive chairman of the board, but his empire is in ruins: WeWork’s IPO has been delayed indefinitely, and its valuation has collapsed from $47 billion to as low as $10 billion.

What is the lesson of WeWork? (Other than that it is a bad idea to self-deal to the almost comical extent that Neumann did.) One conclusion is that venture capital investors are not nearly as smart as they think they are. For years, WeWork’s valuation has been way out of step with that of peer companies that sublet office space. Back in 2017, the Wall Street Journal’s Eliot Brown—the preeminent chronicler of WeWork’s absurd business culture—noted that WeWork’s valuation-per-desk was more than 20 times higher than its rival, IWG. Per square foot, WeWork was 40 times more valuable. Still, the money kept pouring in: $700 million in bond sales last year and $2 billion earlier this year from the Japanese telecom Softbank, which raised $100 billion for tech investments from sources like Saudi Arabia’s sovereign wealth fund.

WeWork seems to symbolize the pinnacle of Silicon Valley’s irrational exuberance, and no surprise, VCs are already trying to isolate its issues—it’s a New York firm; it’s Softbank’s problem. WeWork’s real issue is both more specific and more general: It’s not really a tech company. And that distinction—more than the scrutiny of public vs. private markets—might be the important takeaway from its fall, because it is far from the only outfit that has pitched itself as a tech company just because it uses smartphones and computers.

It’s hard to find many other companies, however, that claimed their mission was to “elevate the world’s consciousness.” The WeWork debacle has inspired a lot of schadenfreude, and it’s easy to spare some of it for the investors who helped inflate its value. If WeWork had gone public at the price suggested by IPO bankers at Goldman Sachs—between $61 billion and $96 billion—and then cratered, Uncle Bob would have lost his retirement savings. Instead, it’s Masayoshi Son and Mohammed bin Salman who are short a few bucks. Oh well!

Capital invested in private companies has exploded over the past five years. Critics have sometimes said that the trend of “tech” companies delaying going public until they are worth 10 figures means that mom-and-pop investors are missing out on gains that get captured only by the rich and well-connected. Securities and Exchange Commission Chair Jay Clayton, for example, has complained that all the startup value creation happens before the IPO.

WeWork, like Uber before it, offers a kind of counterpoint. Even if you could have invested in Uber in 2016, you would have lost money by now. Well-publicized crashing stock prices of consumer-facing companies like Lyft, Slack, Blue Apron, and Snapchat reinforce the perception that tech companies aren’t worth what they say they are.

It turns out this perception isn’t quite right. Yes, more unprofitable companies than ever are going public—and then, in some cases, plummeting in plain view. But according to Bloomberg, half of them are getting more valuable: Since 2017, in particular, the IPOs of unprofitable companies have outperformed the stock market by “an average of 27 percentage points in their first month.”

It’s just not (with the exception of Beyond Meat) the names you know. The important distinction might be between software companies, like Facebook or Palantir or Oracle, and those that have to muddy their hands in the world of gig workers and real estate and manufacturing. In the latter group are companies like Peloton—a business that makes stationary bicycles but calls itself an “automated vehicle technology company”—or Uber, which is a taxi and delivery company but says it just runs a “marketplace.” Or Sweetgreen, a salad chain valued at $1.6 billion that, according to its chief executive, “doesn’t consider [itself] just a salad place” because, apparently, many salads are ordered through an app. Or Blue Apron. Or WeWork, which is evidently a real estate company with a founder who could convincingly play the role of tech CEO.

As Ben Thompson points out in Stratechery, it’s in those hybrid firms that the big losses are occurring—not just a lack of profits (which again, appears to be par for the course), but a lack of confidence there ever will be profits. “Looking at 29 U.S. tech IPOs over the past two years, 20 have increased in market cap over their offering price, and all of them are pure tech companies with high margins,” Thompson writes. Adding an additional 100 users costs nothing to Adobe or Citrix; for WeWork, it requires a big new 10-year lease—and a huge red mark on the balance sheet. You can’t code your way out of a skyscraper.

It’s a reminder that so much of the technological progress we take for granted in the world—cab rides on demand, electric scooters on every corner, grocery stores with no checkout lines, cars that can park themselves—rests on a whole lot of operating losses and cross-subsidy. Not all tech, but particularly the tech we can see: the corporeal, consumer-facing products we like to use. When the market turns, when the Masayoshi Sons of the world get fed up, it may all vanish.

It makes me think of the Concorde, the supersonic passenger aircraft that flew so fast you could land in New York earlier than you left London. Only a gargantuan bi-state R&D program made it real, but forces were already turning against the plane before its infamous fatal run in 2000, when 113 were killed in an accident at Charles de Gaulle Airport in Paris. The plane was too loud. The fuel was too expensive. No airlines wanted to buy the thing. Just because we had invented it didn’t mean it was here to stay.

Obviously, WeWork did not invent anything so interesting as that. Which is why, ironically, its chances of survival seem high: WeWork offices do seem like places that would help you get work done—if not, perhaps, lift you to a state of higher consciousness.

Readers like you make our work possible. Help us continue to provide the reporting, commentary and criticism you won’t find anywhere else.

Join Slate Plusfrom Slate Magazine https://ift.tt/2mOn3Tq

via IFTTT

沒有留言:

張貼留言